Post-Pandemic Strategy for Physical Retail

Written by James Suh

2020-04-XX

Since the global shutdowns and social distancing protocols, the spike in online orders and pick-ups have strained the supply-chain as many retailers struggled to staff and adapt adequate public safety measures while meeting the demand. There's no doubt that the global pandemic is reshaping the future of retail as we speak. I firmly believe in the global medical community, and this will end. However, brands, especially with physical locations, must take this time to rethink their strategies and plan for the world after the pandemic if they aren’t doing it already.

Today, we will focus on rethinking the future of big-box retail environments and experiences. Several leading brands, big and small, already started to implement BOPIS (Buy it Online Pick up In-store) and curve-side pick-ups in 2019. With 70% of US shoppers using BOPIS more than once and a steady increase in total BOPIS sales each year, more brands have started to put significant investment behind the service. But, how does the BOPIS service interact with the traditional retail experience? How will physical retail change as BOPIS grows? Here's my recommendation on an agnostic strategy for how to approach BOPIS and the in-store experience for the post-pandemic world.

Starting Point

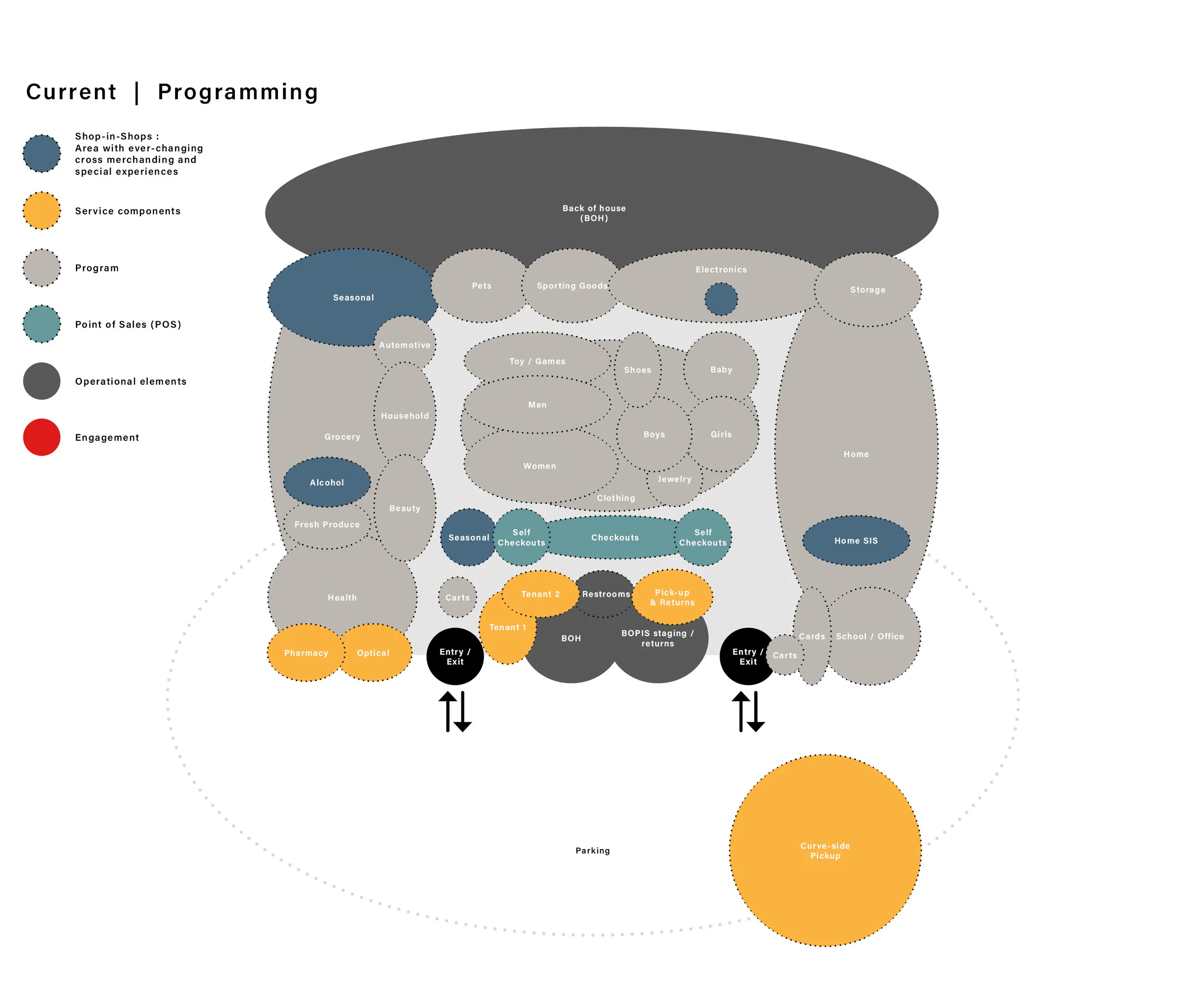

We will use bubble diagrams to show the current status as well as recommendations. The diagram below represents a present-day condition of an agnostic big-box retailer’s programming in the United States.

Identifying the Problem Areas

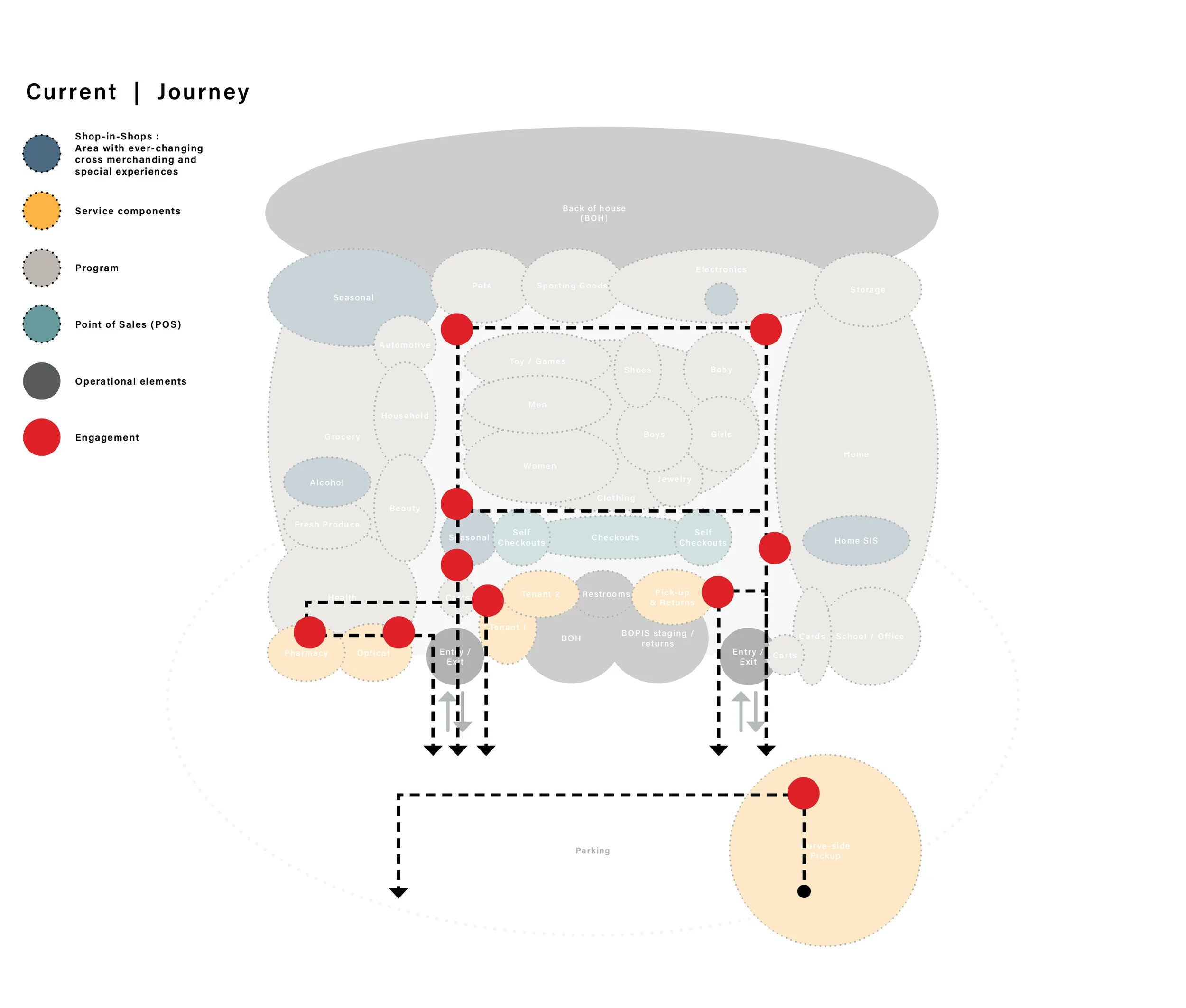

Fragmented BOPIS experience:

Most implemented BOPIS as an addition at the front of the store with a small staging area with impulse products at the POS counter. This area is also often used to accept returns, which results in two different queues and long wait times.

Whopping 85% of shoppers say that they have made an additional in-store purchase while picking up an online order. The retailers must take advantage of the front of the store more and rethink programmatically to entice shoppers to shop around more than just the impulse category.

Forgettable satellite services and partner brands

No matter the offering, these occupants must utilize every inch of the crucial front-of-store footprint. Lower-tiered build-outs and partnerships that miss the mark with the brand's customer base can be a costly mistake. The front of the store is an opportunity to cross-pollinate several different services and brands to complement the shopping experience as well as to give more reasons for shoppers to visit the location.

Underwhelming physical retail experience:

Most big-box retailers' core store concepts remain unchanged for years; guests browse the gondolas, which are laid out usually in grids with occasional small to medium-sized take-over moments. Retailers must create a system of ever-changing and dynamic shop-in-shops throughout a store with cross-merchandising and engaging storytelling with brands they carry.

Underutilized and under-designed site plan:

The retailers must account for the entire shoppers' journey from driving into the shopping plaza to the parking lot to entering the store. Also, the exterior of the building should be activated to not only create a welcoming facade, but also to support partner brands, services, and campaigns.

Recommendations

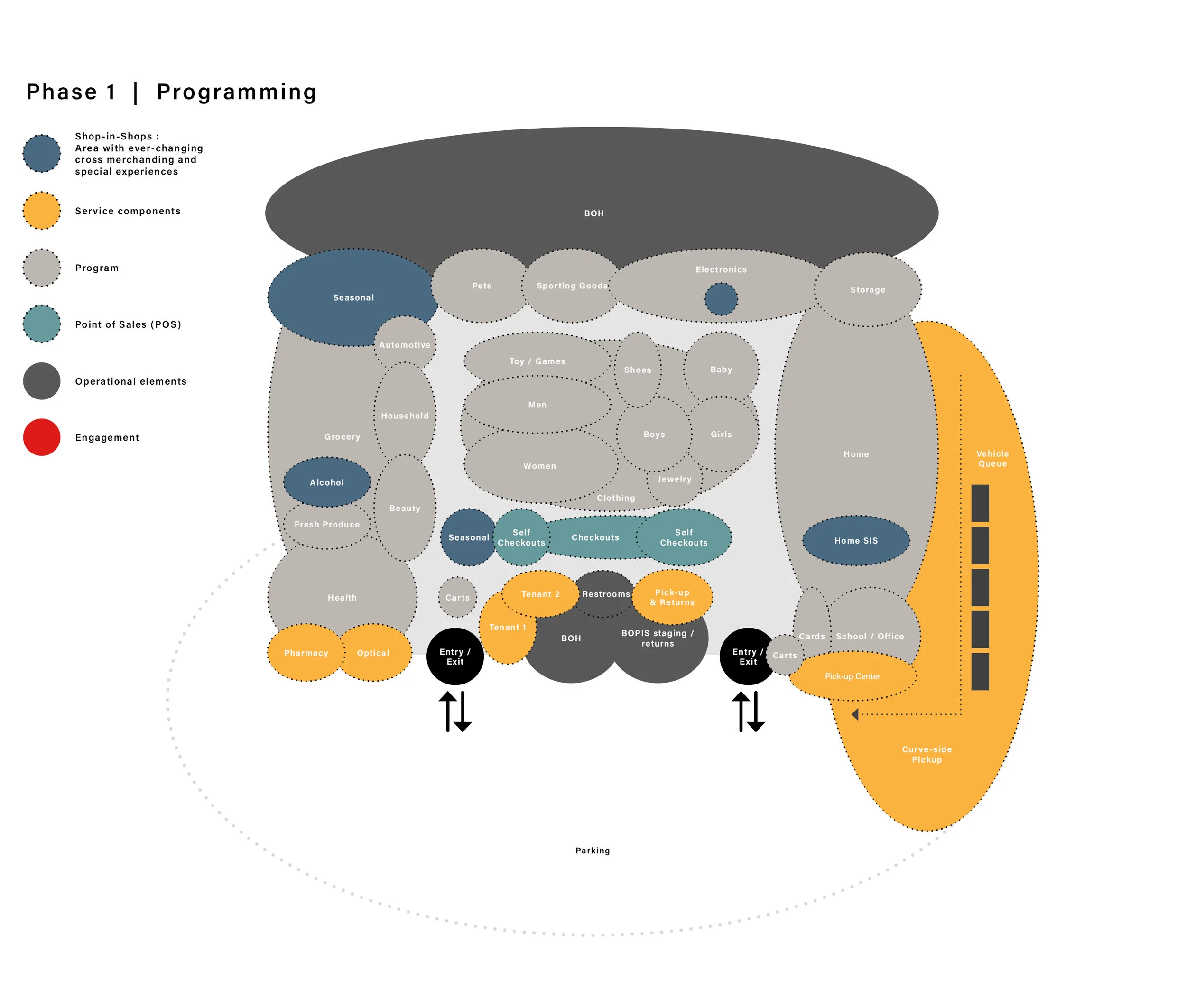

Phase 1 is a day-1 adaptation strategy with minor disruption in the in-store experience, which includes expanded self-checkouts and addition of Pick-up center at the front exterior of the store along with a designated vehicle queue.

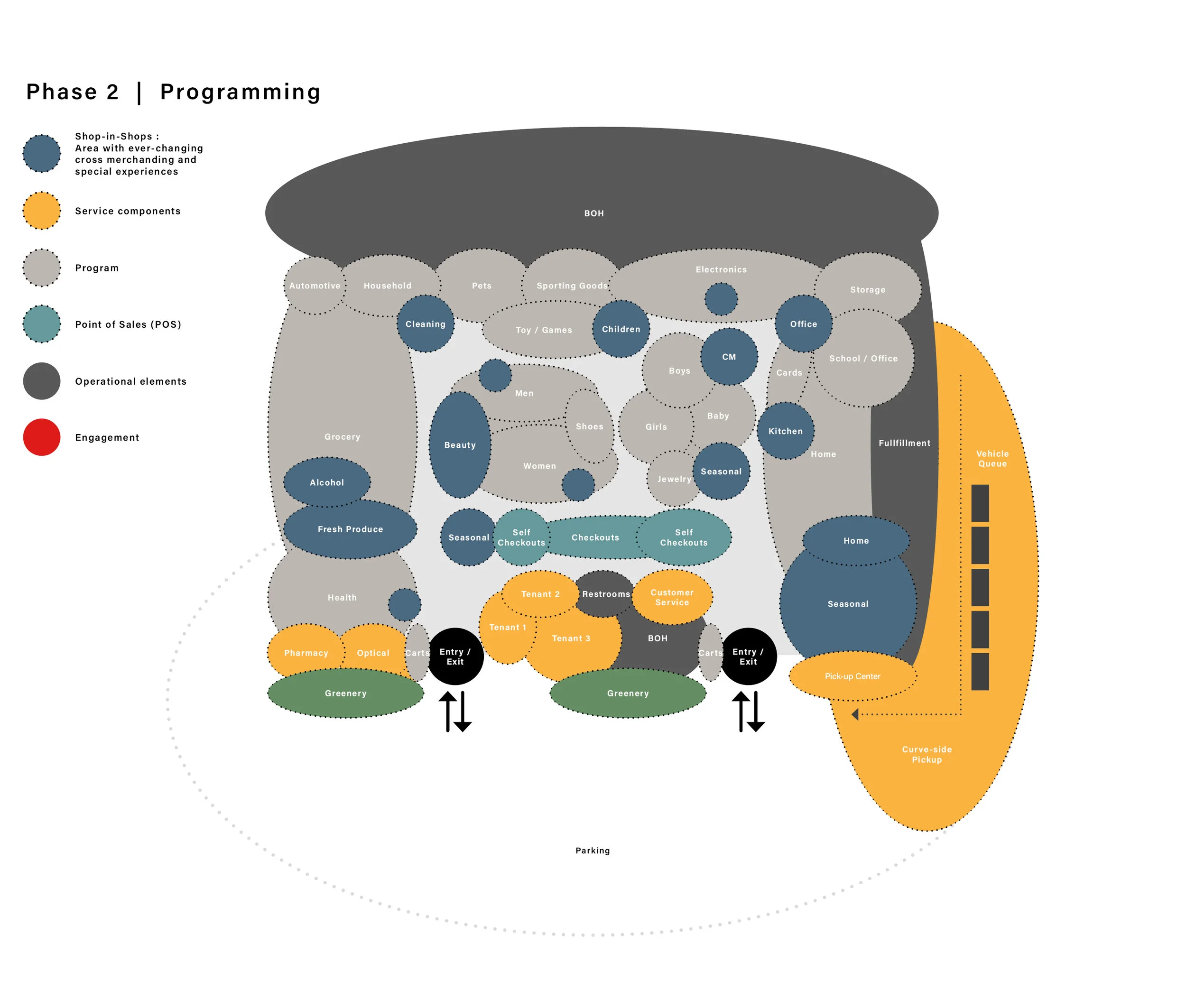

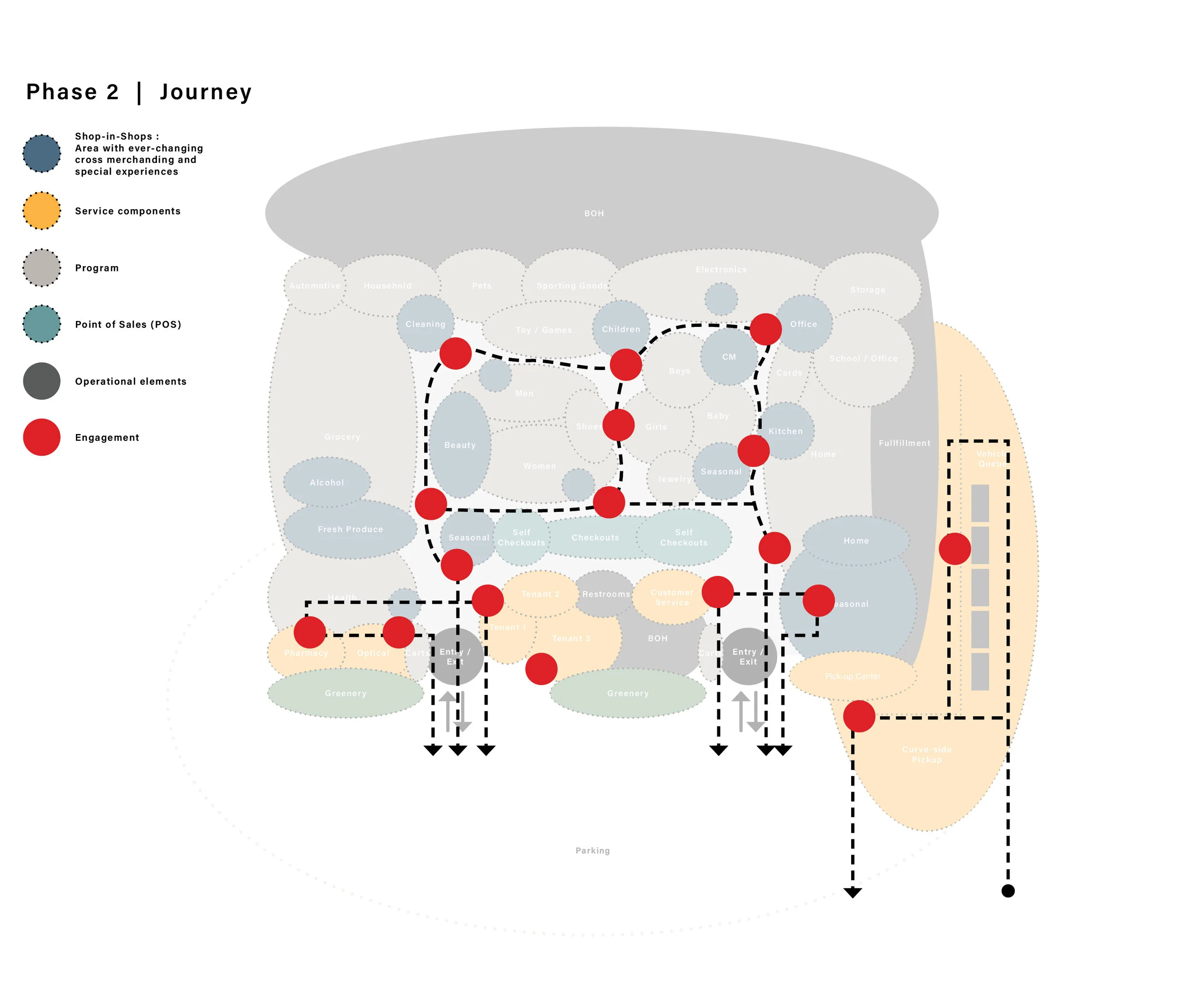

Phase 2 is a long term goal. The concept is to develop a system of shop-in-shops placed strategically within the store environment. The intention is to develop every significant category as an individual destination as well as to create a framework where branded storytelling can happen in a meaningful way.

Convert existing retail locations with expanded and more efficient fulfillment capability for online delivery and pick-up orders

I do not expect very many new store locations in the near future. However, the pandemic-caused economic downturn should not stop the brands from investing in themselves. I recommend focusing on improving existing store build-outs while addressing improving BOH (Back Of House) operations.

Phase 1 adds the pick-up center at the front/exterior of the store to create a logical destination for curve-side pick-up customers. Phase 2 adds the fulfillment center to address better operational flow. I recommend canopy build-outs based on the store location to make the pick-up available throughout the year, no matter the weather conditions.

Less stuff on shelves, more experiences

There's no doubt the grid is efficient and easier to maintain. There is a reason why most big-box retailers used this core concept for years. However, we are not robots; we do not move or think in straight lines. I am not suggesting abolishing gondolas or putting in curved things for the sake of change. It's more about the strategic addition of the shop-in-shops that break the typical racetrack customer paths. It is a great way to refresh the store without significant operational change while accounting for every touchpoint.

Investing in satellite services & partnerships

The front of the store is an excellent opportunity to tell the lifestyle story while complementing the shopping experience. Every inch must be able to justify and ladder up to the question - does it help establish the cohesive brand voice? I recommend higher tier build-outs and carving out additional tenant space for a local brand/service, which will help create meaningful localization of each store.

Better e-commerce experience

50 percent of consumers have decided where to shop online based on whether they could pick up their order in-store. This is a step for any retailer must take regardless of its size. Without investing in the digital storefront, any in-store build-out becomes shot in the dark.

Conclusion

I do not expect very many new store locations in the near future. However, the pandemic-caused economic downturn should not stop the brands from investing in themselves. I recommend focusing on improv